Experience has led us to be a company that is ready to overcome various obstacles with an efficient and effective solution.

UD Intraco, a trading business engaged in the spare parts trading, was established in Jakarta.

Become a Limited Company [PT], and change the name into PT Intraco Penta.

Appointed as a distributor of NV PD Pamitran, Clark Equipment's heavy equipment distributor

Trusted to be a distributor of Renault trucks.

Add to line up of heavy equipment products, Farm Tractors Lamborghini and Bell

Acquired NV PD Pamitran as well as being a brand holder of VME, P&H / PPM, and Bobcat.

Listed on the Jakarta Stock Exchange [now the Indonesia Stock Exchange] on June 30, with 29 million shares to obtain Rp 29 billion.

Starting SAP implementation for Corporate Information Technology, an integrated ERP system.

Acquired Intan Baruprana Finance [IBF] as well as renewed the IBFN business field to become a heavy equipment financing company.

Record sales increase of 50% and revenue growth of 240%

INTA equity was increased by 133%.

Intan Baruprana Finance's (IBF) total assets increased five-fold as well as being rated as one of the best leasing companies in Indonesia for three consecutive times.

Declared a Decade of Innovation as a strategic theme of the Company, in its efforts to continue growth and gain other business opportunities.

INTA recorded a total revenue for more than Rp1 trillion, with total increase of net income by 141%.

INTA succeeded to maintain total revenue above Rp1 trillion, while net profit rose by 63.3%, despite lower demand due to the global economic crisis and appointed as Mahindra & SDLG dealers.

INTA acquired Terra Factor Indonesia [TFI] and Columbia Chrome Indonesia [CCI] with a transaction value of Rp170 billion, and established a Sharia Business Unit in IBF.

INTA set a new record in financial performance, reaching a total asset of IDR 3.7 trillion and revenue of IDR 3 trillion. INTA was also appointed to be the sole distributor in Indonesia to market Sinotruk brand products from China.

INTA was included on the LQ45 Index list on the Indonesia Stock Exchange as well as list of 50 Indonesian Best Companies by Forbes Indonesia magazine and became the Top Performing Company by Investor magazine.

INTA through PT Intraco Penta Prima Servis [IPPS] won the 2013-2014 Volvo Master Champion South East Asia HUB, an inter-mechanical competition held by Volvo Construction Equipment for the levels of Southeast Asia and Asia Pacific [including Australia and New Zealand].

On May 2, 2014, INTA inaugurated INTA Institute, an educational institution that aims to prepare superior and qualified workforce in the field of heavy equipment. INTA institute is located in an area of 8,000 m2 in Cakung. In the same year, IBFN listed its shares on the Indonesia Stock Exchange on December 22, 2014 with the IBFN share code. In this IPO, IBFN released 21.05% of the shares to the public with a fund of Rp192 billion. Most of these funds will be used for working capital financing.

INTA formed a new subsidiary, PT Inta Sarana Infrastruktur and PT Inta Daya Perkasa, which is a holding and sub-holding business in the field of independent electricity supply infrastructure. This is an initial step for INTA to diversify in the field of electricity generation Inta Daya Perkasa together with the Power Construction Corporation of China (PCCC) to form a joint venture company PT Tenaga Listrik Bengkulu which develops 2x100 MW capacities with an investment of USD 350 million. In addition, in 2015 INTA was appointed as a distributor of Palfinger Sany, a knuckled truck mounted crane manufacturer from Europe that was assembled in China. Palfinger Sany is a leading brand in its segment with more than 75 years of experience and controls 30% of the world market share.

INTA through the TLB signed a Memorandum of Understanding (MoU) with PT Pelabuhan Indonesia II (Persero) or IPC in the construction and operation of the power plant in Bengkulu. In the same year, INTA together with the Governor of Bengkulu, H. Ridwan Mukti and the directors of PT PLN (Persero) and PT Pelabuhan Indonesia II (Persero) as the landowners of the Steam Power Plant (PLTU) inaugurated the laying of the first stone in the PLTU Project Bengkulu

INTA officially entered into energy and electricity sector by acquiring Steam Power Plants (PLTU) which are already active in Batam through the purchase of 30% of PT TJK Power's shares valued at Rp 337.5 billion with the Rights Issue mechanism of shares on the Indonesia Stock Exchange

INTA through IPPS became a distributor of Dresta, a heavy equipment owned by the Chinese company LiuGong Dresta Machinery. In addition, IBF successfully reached Homologation with creditors and obtained a new investor PT Northcliff Indonesian through PMHMETD process.

A subsidiary of Intraco Penta Group opened a dealership in Balikpapan to distribute Tata Motors commercial vehicle products

INTA is a distributor for world-class heavy equipment brands such as LiuGong Machinery, the world's 10th largest construction equipment manufacturer by market share and the largest wheel loader manufacturer in the world. Distributor of world class equipment spare parts company, namely Blumaq

INTA inaugurated the CRC (Component Rebuild Center) facility specifically for LiuGong products from China. Where, this CRC facility is the first in the world for LiuGong in Indonesia, at the same time with this CRC facility it can further increase the productivity of loyal INTA customers by minimizing machine downtime due to damaged components.

We are sound and professional in achieving the Company's goals and always do a serious work in upholding and implementing the spirit of values: CINTA

The ability to identify opportunities and take actions in building a positive and strategic relationship, inter- individual, group, department, unit or organization to help achieving business goals.

The ability to make improvements, continuous development and creating something new, both in form of ideas and real works in order to improve business processes that are able to generate maximum performance.

The ability to develop broad beneficial relationships with various groups of people from various internal and external institutions either related or not to the field of employment.

The ability to be a reliable, trustworthy and with a great relationship and mutual benefit in the workplace.

The ability to provide confidence and certainty to the actions in work activities carried out in accordance with the standards (time, quality and cost) that are set.

Our Company Structure is designed to maximize the company's performance over a long period of time by optimizing synergies.

See DetailWe have a well-designed organizational structure to sustain the pace of the company for future business developments.

See DetailWe have reliable, professional and experienced resources to supervise the company in achieving the highest achievement.

Our professionals will strive to provide the best performance for the realization of the company's success in the present and future

Reliability is a reflection of our corporate values that is embedded to our work culture.

We have professionals to conduct audits precisely and carefully in achieving best practice standards.

Our professionals always strive to provide the best as a reflection of the company's values that are always moving forward.

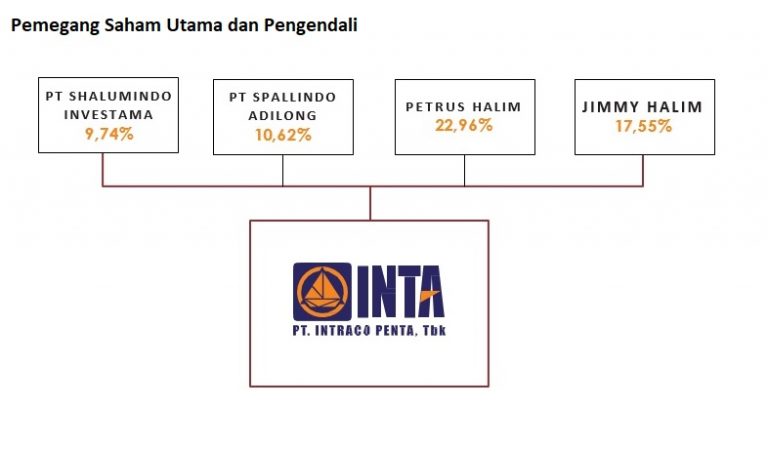

| Pemegang Saham | Jumlah Saham | Presentase Kepemilikan |

|---|---|---|

| PT. Spallindo Adilong | 354.745.132 | 10.62 % |

| PT. Shalumindo Investama | 325.318.789 | 9.74 % |

| Petrus Halim | 766,657,928 | 22.96 % |

| Jimmy Halim | 585,964,410 | 17.55 % |

| HPAM Ultima Ekuitas 1 | 181,135,100 | 5.42 % |

| Reksa Dana HPAM Ekuitas Progresif | 184,400,550 | 5.52 % |

| Masyarakat lainnya | 941,416,353 | 28.19 % |

| Entitas Anak | Jenis Usaha | Presentase Kepemilikan | Lokasi |

|---|---|---|---|

| PT. Intan Baruprana Finance (IBFN) | Financing | 72.30 % | Jakarta |

| PT. Terra Factor Indonesia (TFI) | Trading & Rental Service | 96.87 % | Jakarta |

| PT. Karya Lestari Sumber Alam (KLS) | Mining Contractor | 73.02 % | Jakarta |

| PT. Inta Trading | Trading | 100 % | Jakarta |

| PT. Columbia Chrome Indonesia | Workshop & Manufacturing | 100 % | Jakarta |

| PT. Inta Resources (IR) | Trading, Construction, Manufacturing, Plantation, Transportation & Services | 100 % | Jakarta |

| PT. Intraco Penta Prima Servis | Trading & Service | 99.99 % | Balikpapan |

| PT. Intraco Penta Wahana | Trading & Service | 99.99 % | Jakarta |

| PT. Inta Sarana Infrastruktur | Infrastructure | 100 % | Jakarta |

| PT. Inta Daya Perkasa | Energy | 100 % | Jakarta |